What You Ought to Know:

– Zimmer Biomet Holdings, a worldwide medical know-how chief, and Monogram Technologies Inc., an orthopedic robotics firm, introduced a definitive settlement for Zimmer Biomet to acquire all excellent shares of Monogram.

– The deal, valued at an upfront fee of $4.04 per share in money (roughly $177M fairness worth, $168M enterprise worth), will considerably develop Zimmer Biomet’s surgical robotics portfolio and place it to develop into the primary firm in orthopedics to supply a totally autonomous surgical robotic.

– Monogram widespread stockholders may even obtain a non-tradeable contingent worth proper (CVR) entitling them to obtain as much as $12.37 per share in money if sure product improvement, regulatory, and income milestones are achieved by 2030. The boards of administrators of each firms have unanimously accepted the proposed transaction.

First Totally Autonomous Surgical Robotic

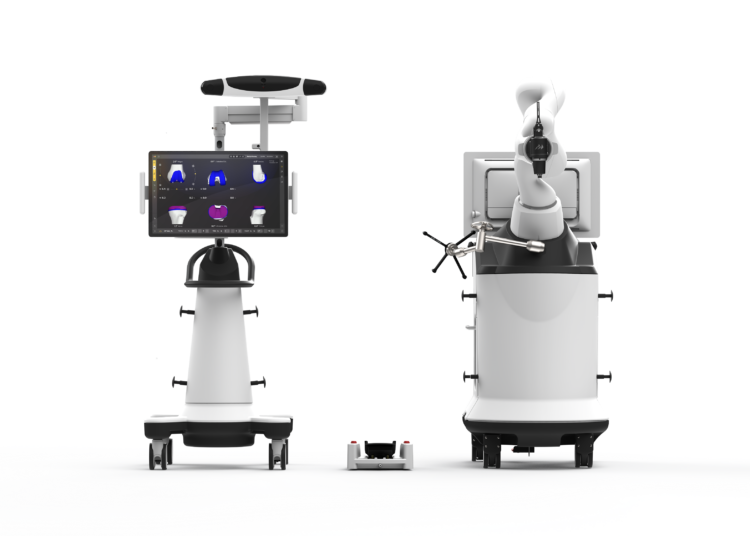

Monogram’s semi- and totally autonomous robotic applied sciences are anticipated so as to add new and differentiated capabilities to develop Zimmer Biomet’s flagship ROSA® Robotics platform and its broad suite of navigation and enabling applied sciences. Monogram has developed a CT-based, semi-autonomous, AI-navigated complete knee arthroplasty (TKA) robotic know-how, which acquired FDA 510(ok) clearance in March 2025 and is anticipated to be commercialized with Zimmer Biomet implants in early 2027.

Crucially, Monogram can also be creating a totally autonomous model of this know-how with the potential to considerably improve security, effectivity, and outcomes, in addition to further purposes past TKA. Upon closing of the proposed transaction, Zimmer Biomet anticipates having a transparent pathway to develop into the primary and solely firm in orthopedics to supply a totally autonomous surgical robotic.

Increasing a Complete Robotics Portfolio

The proposed transaction expands Zimmer Biomet’s in depth suite of orthopedic robotics, enabling options and analytics designed to deal with the wants of surgeons pre-, intra-, and post-operatively. Zimmer Biomet’s broad portfolio at the moment options imageless robotics by its ROSA platform; a licensed CT-based handheld robotic; blended actuality navigation; AI-based surgical navigation; and a pathway to superior semi- and totally autonomous robotics capabilities. This positions Zimmer Biomet to uniquely clear up for the various preferences of a variety of surgeons globally, addressing a number of kinds of surgical strategies, together with CT and non-CT; robotic and non-robotic; and guide, surgeon-centered strategies or semi- or totally autonomous applied sciences.

The ROSA platform, the cornerstone of Zimmer Biomet’s robotics providing, is quickly approaching 2,000 installations worldwide and is a market chief exterior the USA. Zimmer Biomet is dedicated to persevering with to advance the ROSA platform, investing in a strong R&D pipeline that features a number of new product and software program purposes anticipated between now and 2027. This consists of ROSA Knee with OptimiZe (submitted to the FDA with 510(ok) clearance anticipated later this 12 months), in addition to ROSA Posterior Hip and the complete business launch of ROSA Shoulder.

“Monogram’s know-how is a significant leap ahead, demonstrating our dedication to changing into the boldest and broadest innovator in surgical robotics and navigation,” mentioned Ivan Tornos, Chairman, President, and Chief Government Officer of Zimmer Biomet. “Upon closing, our customer-centric portfolio will encompass probably the most complete and versatile know-how ecosystem to assist the various preferences of an unlimited array of surgeons—now and into the longer term. With Monogram’s proprietary know-how, Zimmer Biomet has the potential to develop into the primary firm to ship totally autonomous capabilities and redefine each the usual of care and the way forward for orthopedic surgical procedure.”

Zimmer Biomet plans to fund the proposed transaction by a mix of money on the stability sheet and different accessible debt financing sources, anticipating to take care of a powerful stability sheet and assist its acknowledged capital allocation priorities.