The proprietor of Waterstones is near hiring bankers to work on a multibillion-pound itemizing of the transatlantic bookseller.

Sky Information has learnt that Elliott Administration is getting ready to nominate Rothschild to behave as an impartial adviser on its flotation choices, with a public market debut more likely to happen as quickly because the second quarter of this 12 months.

Sources stated that Rothschild’s possible engagement was the clearest signal to date that London is well-placed to overcome New York within the battle to stage the itemizing of one of many world’s main e book retailers.

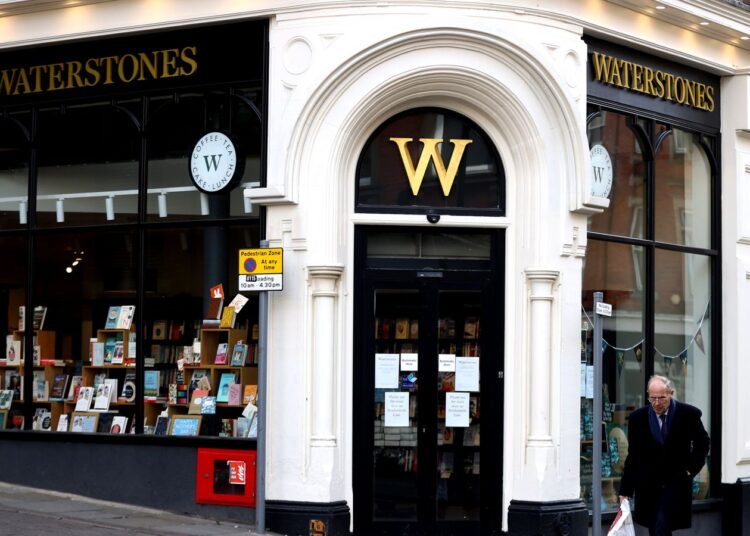

In addition to Waterstones, the group additionally owns Barnes & Noble, which trades from tons of of shops within the US.

In Britain, the corporate trades from about 315 shops and employs roughly 4,000 folks.

It has been reworked below the management of James Daunt, founding father of the eponymous retail chain, which is individually owned by him.

Sky News reported in October that Mr Daunt had been among the many attendees at a roundtable hosted by Rachel Reeves, the chancellor, in an try to advertise the London Inventory Trade as an inventory venue.

Final month, the Monetary Instances stated the corporate had kicked off talks with potential advisers on a deal.

Various different banks will probably be appointed within the coming months to supervise the general public itemizing and share sale.

Elliott declined to remark.