Keep knowledgeable with free updates

Merely signal as much as the US equities myFT Digest — delivered on to your inbox.

US shares rallied on Friday, wiping out the steep losses that adopted Donald Trump’s “liberation day” tariff announcement a month in the past, after labour market information exceeded expectations.

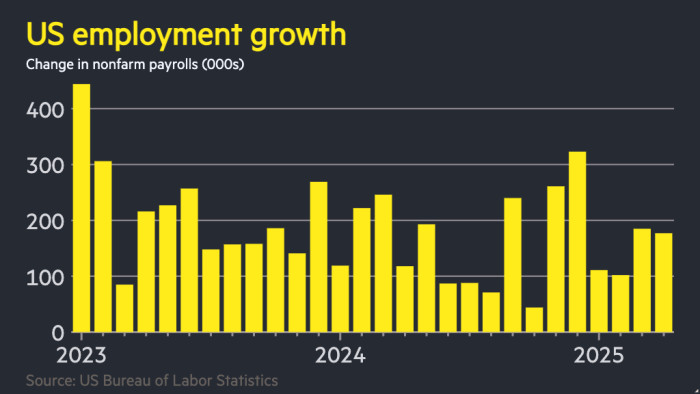

The 177,000 jobs added in April, in keeping with the Bureau of Labor Statistics, surpassed the 135,000 predicted by economists polled by Bloomberg, though the quantity marked a fall from March.

The S&P 500 jumped 1.5 per cent on Friday, bringing it above the closing stage from April 2, when the US president unveiled his “reciprocal tariffs”. Friday’s advance was the ninth consecutive each day achieve for the S&P 500, the longest profitable streak since 2004, and rating amongst its longest on document, in keeping with Monetary Occasions evaluation.

Wall Avenue’s benchmark share index had plunged as a lot as 15 per cent in a number of days of turbulent buying and selling after Trump’s announcement, triggering tumult throughout international monetary markets.

However international equities have since largely recovered, helped by indicators of a doable thaw in commerce tensions, together with feedback by China’s commerce ministry on Friday that Washington had not too long ago expressed “a want to interact in discussions” on commerce.

“This rally appears to be on the expectation that — almost about tariffs — the worst has handed,” stated Ajay Rajadhyaksha, international chair of analysis at Barclays. However he added: “In actual fact it’s precisely the opposite. The worst has not but proven up within the information. Nothing has proven up within the information but.”

Wall Avenue’s restoration was echoed throughout a number of different international locations because the preliminary wave of world inventory market volatility after Trump’s “liberation day” tariff plans subsided. Indices throughout the Asia-Pacific area and Europe notched up multi-day good points.

Most notably, the UK’s FTSE 100 added 1.2 per cent on Friday to rise for a fifteenth consecutive session, its longest profitable streak on document.

Regardless of the restoration in inventory markets, the greenback stays nearly 4 per cent under its “liberation day” stage.

After Friday’s jobs information, the yield on two-year Treasuries, which tracks rate of interest expectations and strikes inversely to costs, rose 0.13 share factors to three.83 per cent as buyers wager that the US Federal Reserve would maintain borrowing prices increased for longer.

“Folks had been petrified of a draw back shock that wasn’t forthcoming,” stated Mike Riddell, a fund supervisor at Constancy Worldwide.

Merchants proceed to forecast no less than three rate of interest cuts this 12 months, however the probability of a fourth halved to about 30 per cent from round 60 per cent earlier than the roles figures.

Goldman Sachs stated that it had pushed again its expectations of the following charge lower a month from June to July.

“THE FED SHOULD LOWER ITS RATE!!!” Trump posted on his Reality Social community shortly after the roles information got here out, as he hailed “employment sturdy, and far more excellent news”.

Friday’s jobs numbers got here after mass firings of hundreds of federal workers by Elon Musk’s so-called Division of Authorities Effectivity. The information indicated that federal authorities employment declined by 9,000 in April and by 26,000 since January.

Along with April’s headline determine of 177,000 new jobs, the full quantity for March was revised down from 228,000 to 185,000.

The unemployment charge was unchanged from March at 4.2 per cent.

Claudia Sahm, chief economist at New Century Advisors, stated that whereas Trump’s financial insurance policies had been “something however refined” their preliminary influence was “comparatively small”.

She added that it will take time for the insurance policies “to work by means of the system, which implies the Fed goes to attend”, and that any cuts had been possible later within the second half of the 12 months quite than in the course of the subsequent two months.

Official information this week indicated the first fall in GDP for three years however was distorted by a surge in imports forward of Trump’s tariff announcement, with home demand remaining sturdy.

Many economists anticipate that the duties will act as a drag on underlying progress within the second quarter of the 12 months.

“General this is a sign that the labour market shouldn’t be deteriorating but,” Gennadiy Goldberg, head of US charges technique at TD Securities, stated of Friday’s job information. “However buyers are nonetheless nervous that one other shoe will drop. We simply don’t know when.”

Further reporting by Ian Smith in London