Unlock the Editor’s Digest without spending a dime

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

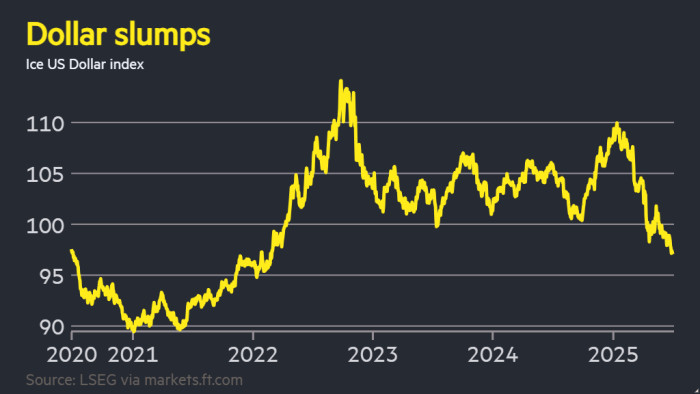

The US greenback is headed for its worst first half of the 12 months since 1973, as Donald Trump’s commerce and financial insurance policies immediate world buyers to rethink their publicity to the world’s dominant forex.

The greenback index, which measures the forex’s energy towards a basket of six others together with the pound, euro and yen, has slumped greater than 10 per cent up to now in 2025, the worst begin to the 12 months because the finish of the gold-backed Bretton Woods system.

“The greenback has change into the whipping boy of Trump 2.0’s erratic insurance policies,” stated Francesco Pesole, an FX strategist at ING.

The president’s stop-start tariff war, the US’s huge borrowing wants and worries concerning the independence of the Federal Reserve had undermined the attraction of the greenback as a protected haven for buyers, he added.

The forex was down 0.5 per cent on Monday because the US Senate ready to start voting on amendments to Trump’s “large, lovely” tax invoice.

The landmark laws is predicted so as to add $3.2tn to the US debt pile over the approaching decade and has fuelled considerations over the sustainability of Washington’s borrowings, sparking an exodus from the US Treasury market.

The dollar’s sharp decline places it on target for its worst first half of the 12 months since a 15 per cent loss in 1973 and the weakest exhibiting over any six-month interval since 2009.

The forex’s slide has confounded widespread predictions initially of the 12 months that Trump’s commerce battle would do higher injury to economies exterior the US whereas fuelling American inflation, strengthening the forex towards its rivals.

As a substitute, the euro, which a number of Wall Avenue banks had been predicting would fall to parity with the greenback this 12 months, has risen 13 per cent to above $1.17 as buyers have targeted on progress dangers on the planet’s largest financial system — whereas demand has risen for protected property elsewhere, similar to German bonds.

“You had a shock when it comes to liberation day, when it comes to the US coverage framework,” stated Andrew Balls, chief funding officer for world fastened earnings at bond group Pimco, referring to Trump’s “reciprocal tariffs” announcement in April.

There was no vital menace to the greenback’s standing because the world’s de facto reserve forex, Balls argued. However that “doesn’t imply that you may’t have a major weakening within the US greenback”, he added, highlighting a shift amongst world buyers to hedge extra of their greenback publicity, exercise which itself drives the dollar decrease.

Additionally pushing the greenback decrease this 12 months have been rising expectations that the Fed will lower charges extra aggressively to help the US financial system — urged on by Trump — with no less than 5 quarter-point cuts anticipated by the tip of subsequent 12 months, in line with ranges implied by futures contracts.

Bets on decrease charges have helped US shares to shake off commerce battle considerations and battle within the Center East to achieve file highs. However the weaker greenback means the S&P 500 continues to lag far behind rivals in Europe when the returns are measured in the identical forex.

Massive buyers from pension funds to central financial institution reserve managers have acknowledged their need to cut back their publicity to the greenback and US property, and questioned whether or not the forex continues to be offering a haven from market swings.

“International buyers are requiring higher FX hedging for dollar-denominated property, and that has been one other issue stopping the greenback from following the US fairness rebound,” stated ING’s Pesole.

Gold has additionally hit file highs this 12 months on continued shopping for by central banks and different buyers frightened about devaluation of their greenback property.

The greenback stoop has taken it to its weakest stage towards rival currencies in additional than three years. Given the pace of the decline, and the recognition of bearish greenback bets, some analysts count on the forex to stabilise.

“A weaker greenback has change into a crowded commerce and I believe the tempo of decline will gradual,” stated Man Miller, chief market strategist at insurance coverage group Zurich.