Unlock the White Home Watch publication free of charge

Your information to what the 2024 US election means for Washington and the world

The creator is vice-chair at Oliver Wyman and former world head of banks and diversified financials analysis at Morgan Stanley

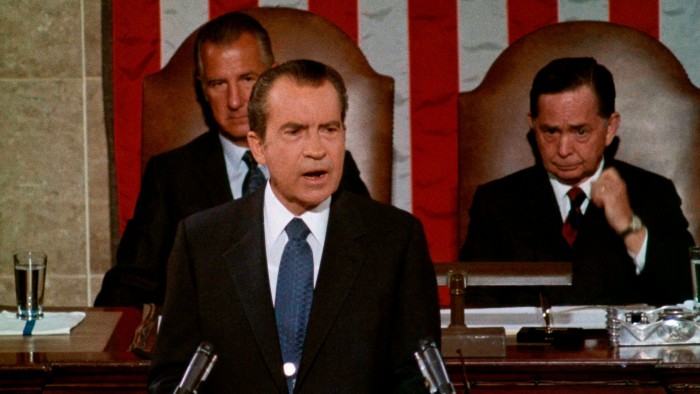

What is going to the longer-term monetary penalties of Trump’s tariffs be? We could also be in a 90-day pause however the query stays pressing. A glance again at Richard Nixon’s expertise in 1971 might assist traders perceive what would possibly occur subsequent.

Actually latest occasions share some hallmarks with the “Nixon shock”, which occurred when the then president took the greenback off the gold normal, applied a ten per cent import tariff and launched momentary value controls. This de-anchoring of the regime resulted in a interval of world financial instability and uncertainty. It not solely brought about a loss in enterprise confidence however led to stagflation. Nixon’s value and wage controls spectacularly backfired, triggering product shortages and serving to to gasoline a wage-price spiral. The entire episode was a pivotal contributor to the large inflation of the ‘70s.

As with Trump’s tariffs, Nixon’s had been launched to cudgel nations into altering the phrases of commerce to assist cut back the US commerce deficit. His greatest issues had been Japan and Germany. “My philosophy, Mr President, is that every one foreigners are out to screw us and it’s our job to screw them first,” Treasury secretary John Connally had stated to him.

In at the moment’s hyperfinancialised world, we’ve got already seen that bond markets can power the palms of politicians much more rapidly. It took 4 months in 1971 earlier than Nixon’s tariffs had been eliminated by way of the Smithsonian settlement. However the shock had already finished sufficient to catalyse extraordinary modifications in finance, resulting in the creation of latest devices to wager on the path of rates of interest and hedge forex danger, together with FX futures and choices.

The ache of stagflation within the banking system prompted an enormous change in monetary behaviour and monetary regulation. Buyers shifted asset allocation to gold and actual belongings to protect worth. In the meantime corporates and depositors more and more moved their actions from banks to bond markets. Financial institution lending as a share of whole borrowing within the financial system has been falling ever since. Briefly, fashionable finance was solid within the early Nineteen Seventies.

There are parallels as properly for nations exterior the US at the moment worrying about tariffs. Again in 1971 there was additionally shoddy therapy for the US’s closest allies. Nixon hit Canada with tariffs regardless of its forex already floating. Like Prime Minister Mark Carney at the moment, Canadians didn’t again down and finally the tariffs had been eliminated. It might have been even worse: Connally had additionally wished the US to withdraw from a long-standing pact with Canada on automobiles and auto components. However Paul Volcker mounted that, in keeping with his memoirs, by cheekily encouraging a State Division official to tear off the final web page of each press launch which talked about it.

Finally, the necessity to stabilise worldwide relations with allies helped tip the steadiness away from the tariffs. Henry Kissinger, then the nationwide safety adviser, “grew involved in regards to the unsettling affect of a protracted confrontation on allied relationships”.

Nixon additionally put big stress on the Fed for expansionary financial coverage to offset the shock. William Safire, Nixon’s speechwriter, recounts how the administration stored up a gradual stream of nameless leaks to stress Fed chair Arthur Burns, together with floating one proposal to broaden the dimensions of the Federal Reserve, in order that Nixon might pack the committee with supportive new members.

On the finish of all of it, Nixon’s four-month tax might have helped facilitate greenback revaluation, however it fell in need of the specified objectives and had no discernible affect on imports. The transfer’s financial shockwaves, nonetheless, rippled by way of the a long time. Even the creation of the euro stems from it. May a digital euro or deeper European capital markets be subsequent? It’s not but clear however historical past suggests the fallout from this newest shock will probably be felt for years to come back.