On April 30, Kraken formally launched Kraken Embed, a streamlined Crypto-as-a-Service (CaaS) product designed to assist banks, FinTechs, and neobanks rapidly combine crypto buying and selling into their platforms. The answer goals to take away conventional infrastructure, regulation, and liquidity hurdles by offering a plug-and-play crypto modular API that may be added to current apps or web sites.

Kraken Embed arrives as monetary establishments face rising demand for crypto entry, however lack the inner sources to construct compliant methods from scratch. By leveraging Kraken’s established regulatory framework and liquidity swimming pools, Embed permits platforms to supply crypto buying and selling on to their prospects beneath their very own model. The launch marks a major milestone in Kraken’s institutional growth and opens the door for extra regulated crypto entry for banks throughout Europe and past.

Kraken Embed Defined

Kraken Embed is a CaaS platform that enables monetary establishments to supply crypto buying and selling with minimal setup. It’s straightforward to arrange through modular APIs that combine into web sites or cell apps, enabling direct crypto purchases, gross sales, and portfolio monitoring with out in-house infrastructure or licenses.

Designed for speedy deployment, Embed presents a short while to market. Establishments can onboard customers utilizing Kraken’s regulated backend, with Kraken dealing with custody, execution, and compliance.

This reduces companions’ complexity and ensures a regulated crypto buying and selling resolution that scales. With Kraken Embed, establishments can meet demand with out absorbing regulatory burdens or constructing proprietary buying and selling methods.

Kraken Companions With bunq to Launch Embed in Europe

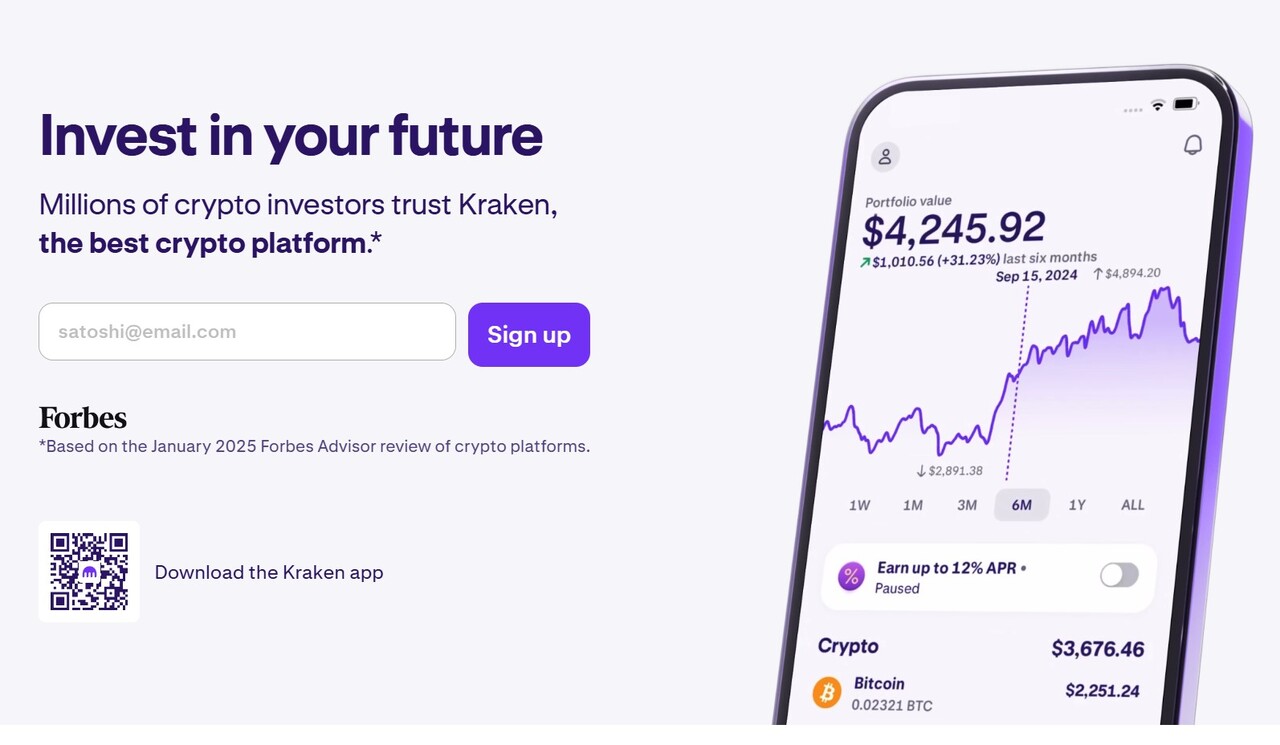

By this partnership, bunq has launched ‘bunq Crypto,’ enabling its customers to put money into over 300 cryptocurrencies, together with Bitcoin, Ethereum, and Solana, straight throughout the bunq app. This integration combines the safety of a completely licensed financial institution with Kraken’s in depth experience in safeguarding digital property.

The service is on the market to bunq customers within the Netherlands, France, Spain, Eire, Italy, and Belgium. Pending regulatory approvals, it plans to increase throughout the European Financial Space, the US, and the UK.

bunq’s current analysis signifies a major demand for built-in monetary providers, with 65% of European world residents looking for a single platform to handle their banking, financial savings, and crypto investments. By leveraging Kraken’s regulated infrastructure by way of the Embed CaaS resolution, bunq addresses this demand, providing a seamless and safe crypto investing expertise inside its banking app.

This collaboration underscores Kraken’s dedication to offering regulated crypto buying and selling options to monetary establishments that align with the regulatory panorama in Europe, notably beneath the Markets in Crypto-Property (MiCA) regulation.

How Kraken Embed Solves Key Challenges for Banks and FinTechs

Kraken Embed marks a major shift in how monetary establishments can strategy crypto integration. By providing a plug-and-play resolution backed by a regulated infrastructure, Embed eliminates the technical, authorized, and operational friction that has lengthy deterred banks and FinTechs from getting into the area.

1. Minimal Setup, Most Entry

Conventional monetary establishments usually lack the technical stack to construct a safe crypto buying and selling interface. Kraken Embed removes this barrier by offering a drop-in resolution. Companions can launch in weeks, immediately connecting their platforms to Kraken’s regulated infrastructure.

2. MiCA-Prepared Crypto Entry for Monetary Establishments

MiCA regulation in Europe locations strict necessities on crypto service suppliers. With Kraken Embed, banks and FinTechs can supply buying and selling providers whereas counting on Kraken’s licensure and compliance frameworks. This reduces each authorized publicity and inner overhead. Kraken already operates in over 190 nations worldwide.

3. Institutional-Grade Liquidity Backed by Kraken’s Market Depth

Embed leverages Kraken’s deep liquidity throughout greater than 370 crypto property. This permits companion establishments to supply aggressive costs and clean execution with out managing their very own order books. Establishments additionally profit from Kraken’s observe file in safe custody and institutional-grade methods.

How MiCA and International Guidelines Are Shaping Crypto Entry

MiCA regulation, which not too long ago took impact throughout the European Union, units the muse for a harmonized crypto market in Europe. This regulatory readability creates new incentives for banks and FinTechs to interact with compliant crypto suppliers. Kraken’s infrastructure is already aligned with MiCA, making Embed particularly well timed.

As world crypto regulation turns into extra outlined, compliance-first options like Kraken Embed will seemingly change into a most popular selection. Establishments search companions who prioritize consumer safety, licensing, and AML/KYC requirements, all areas the place Kraken already meets or exceeds regional necessities.

Crypto Adoption Grows Amongst Banks and FinTechs

In keeping with recent analysis by PYMNTS, a rising variety of banks, together with ING, U.S. Financial institution, and Lynq Community, are exploring crypto choices. Institutional gamers are now not sitting on the sidelines. Whether or not by way of direct buying and selling, custody, or DeFi integrations, conventional finance is steadily shifting towards crypto.

Kraken Embed matches squarely into this shift. By decreasing danger and time-to-market, the product permits banks to answer rising buyer demand with out hiring giant inner groups or pursuing new licenses. Embed positions Kraken as a key crypto companion for establishments at a time when trade curiosity is climbing.

Kraken Feedback on the Launch of Embed

Talking on the launch, Kraken’s Head of Institutional, Brett McLain, famous:

“By Embed, Kraken is extending its deep experience to establishments looking for a dependable, compliant, and frictionless entry level into crypto.”

This assertion reinforces Kraken’s technique to steer the institutional section by providing scalable, secure, and regulation-ready instruments.

Kraken Raises the Bar With Its Embed Providing

With the launch of Kraken Embed, the corporate has launched a sensible resolution for one of many greatest challenges within the monetary sector: integrating crypto safely and effectively. The product offers a quick, compliant path for establishments to satisfy buyer demand whereas avoiding the complexity and danger of constructing in-house methods.

Embed’s early success with bunq, its alignment with MiCA, and its white-label flexibility make it one of the crucial compelling FinTech crypto options obtainable immediately. As crypto adoption continues to rise in Europe and globally, Kraken Embed is well-positioned to change into the go-to infrastructure for banks to entry regulated crypto.

FAQs

jQuery(“.accordionButton”).click on(operate() {

jQuery(“.accordionButton”).removeClass(“on”);

jQuery(“.accordionContent”).slideUp(“regular”);

if(jQuery(this).subsequent().is(“:hidden”) == true) {

jQuery(this).addClass(“on”);

jQuery(this).subsequent().slideDown(“regular”);

}

});

});

What’s Kraken Embed and the way does it work?

Kraken Embed is a Crypto-as-a-Service (CaaS) resolution that enables monetary establishments so as to add crypto buying and selling to their platforms through a easy widget. Kraken handles custody, execution, and compliance, whereas companions keep the client interface.

Why is Kraken Embed vital for monetary establishments?

It permits banks, neobanks, and FinTechs to rapidly supply crypto buying and selling beneath their model with out managing regulatory obligations or constructing new infrastructure. It aligns with MiCA and different regulatory frameworks.

Which establishments are already utilizing Kraken Embed?

bunq, a number one European neobank, is the primary to implement Kraken Embed, providing crypto entry straight inside its banking app. Extra companions are anticipated to comply with.

References

The put up Kraken Launches Embed: Plug-and-Play Crypto Trading for Banks and FinTechs appeared first on ReadWrite.