On July 23, a number of US senators proposed new laws that will apply anti-money laundering (AML) protections to a large variety of professionals within the US artwork market.

The invoice—titled the Art Market Integrity Act—would amend the Financial institution Secrecy Act to require artwork sellers and public sale homes to adjust to anti-money-laundering (AML) and counter-terrorism financing laws. It will additionally apply to artwork advisors, consultants, custodians, galleries, museums, collectors, or “some other one that engages as a enterprise as an middleman within the sale of artistic endeavors.”

If the Artwork Market Integrity Act have been to develop into federal regulation, it might give the US Treasury the authorized authority to topic these artwork professionals and establishments to undertake sure AML insurance policies and safeguards, reminiscent of conducting due diligence on shoppers, sustaining information, and reporting suspicious transactions.

The textual content of the invoice specifies that artistic endeavors embrace “any unique portray, sculpture, watercolor, print, drawing, {photograph}, set up artwork, or video artwork,” and doesn’t embrace utilized artwork reminiscent of “product design, trend design, architectural design, or inside design; or mass-produced ornamental artwork, together with ceramics, textiles, or carpets.’’

The invoice doesn’t comprise particular language relating to furnishings or antiques.

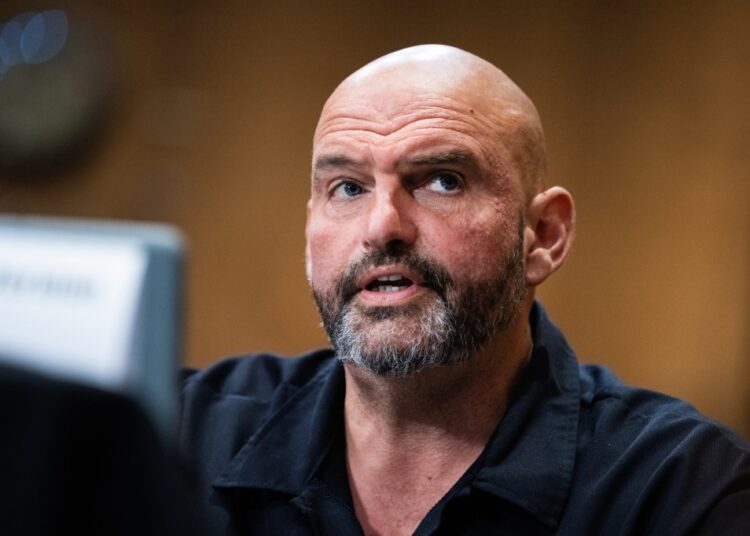

The invoice’s lead writer was Senator John Fetterman (D-PA) on behalf of Senators Chuck Grassley (R-IA), Sheldon Whitehouse (D-RI), Invoice Cassidy (R-LA), Andy Kim (D-NJ), and David McCormick (R-PA).

A press release from Fetterman’s office stated the invoice “particularly targets high-risk artwork market transactions whereas exempting artists themselves and companies with below $50,000 in annual artwork transactions. It will align the US with worldwide requirements already adopted by the UK, European Union, and Switzerland, stopping America from turning into a protected haven for illicit actions.”

The invoice additionally specifies that artwork sellers who shouldn’t have single transactions over $10,000 and don’t whole transactions of $50,000 involving a murals are exempt. It additionally absolutely exempts artists who promote their very own works, in addition to non-profit organizations.

“Artwork needs to be for art-lovers, not terrorists and criminals,” Fetterman stated in a press assertion. “For too lengthy, loopholes have allowed Russian legal kingpins to evade sanctions and terrorists like Hezbollah to funnel cash by artwork offers.”

Final yr, the Treasury Division identified the artwork market as notably prone to cash laundering and the evasion of worldwide sanctions. And over the previous couple of years, a number of excessive profile instances have highlighted this problem.

In 2023, art collector Nazem Ahmad was charged with violating and evading US sanctions by dealing $440 million in artwork and diamonds and utilizing the proceeds to fund the Lebanon-based terrorist group Hezbollah. Russian development billionaires Arkady and Boris Rotenberg were able to purchase $18 million in art regardless of US sanctions imposed in 2014. In 2023, Russian oligarch and artwork collector Roman Abramovich additionally restructured the trust that held the $963 million art collection he amassed in 2018 along with his ex-wife, Dasha Zhukova, forward of the invasion of Ukraine, defending it from seizures attributable to sanctions.

And final yr, the US Division of Justice charged political advisor and Russian tv contributor Dimitri Simes and his spouse, Anastasia Simes, with violating US sanctions through schemes involving art and antiques.

The Artwork Market Integrity Act has acquired endorsements from the Antiquities Coalition, Transparency Worldwide U.S., the FACT Coalition, FDD Motion, the American Jewish Committee, Razom for Ukraine, American Coalition for Ukraine, the Initiative for the Restoration of Venezuelan Property (INRAV), the Nationwide Border Patrol Council, and the Federal Regulation Enforcement Officers Affiliation (FLEOA).

However no less than one professional doesn’t have excessive expectations for the proposed laws.

“Regulation of the opaque artwork market is desperately wanted, however given the success main gamers have up to now had in combating each try to limit their earnings, I’ve little hope this invoice will succeed,” Erin Thompson, a professor of art crime on the John Jay Faculty of Legal Justice, instructed ARTnews.