Anthony Joshua, JK Rowling and Mo Salah have been named among the many UK’s 100 largest taxpayers.

The billionaire brothers behind playing big Betfred topped the rankings of The Sunday Instances Tax Listing 2026 for the primary time, surpassing musicians, entrepreneurs and sports activities stars.

Fred and Peter Achieved, who based the Warrington-based enterprise in 1967, paid out an estimated £400.1m in tax over the previous 12 months, in line with the annual checklist.

It got here after their tax invoice climbed by virtually half from £273.4m a 12 months earlier.

Monetary buying and selling entrepreneur Alex Gerko ranked second on the checklist with £331.4m in tax, adopted by hedge fund boss Chris Rokos, who paid £330m.

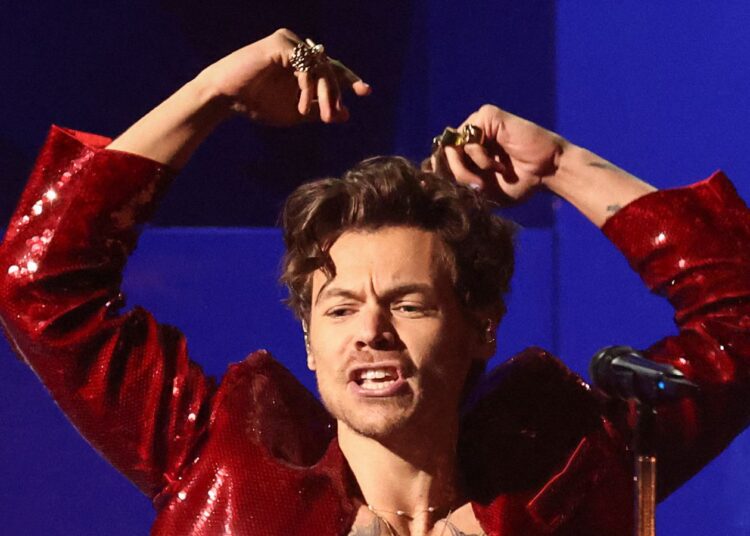

Elsewhere, Harry Types was among the many new entries to the checklist, in 54th place, paying £24.7m in tax.

The previous One Route member-turned-solo artist is ready to launch his fourth studio album in March.

Learn extra from Sky Information:

Riz Ahmed hopes his ‘visceral’ Hamlet will be shown in schools

Yellow warning for parts of England already hit by severe rain

Billionaire businessman Mike Ashley ranked ninth on the checklist, with a contribution of £175m in tax, whereas entrepreneur Sir James Dyson and Nik Storonsky, a co-founder of the funds agency Revolut, additionally featured.

Two footballers additionally joined the checklist for the primary time, with Manchester Metropolis’s Erling Haaland showing in 72nd place with an estimated tax cost of £16.9m and Liverpool’s Salah believed to have a invoice of £14.5m, in 81st place.

Haaland, 25, is the youngest individual to look within the tax checklist.

Harry Potter creator Rowling ranked thirty sixth on the checklist with a invoice of £47.5m, and musician Ed Sheeran sixty fourth, with a £19.9m tax cost. Boxer Anthony Joshua ranked a hundredth, paying £11m.

Wetherspoons founder Sir Tim Martin, 70, ranked eighth within the checklist with a private contribution of £199.7m.

The checklist confirmed that the highest 100 taxpayers handed over a complete of £5.758bn value of tax, up from £4.985bn a 12 months earlier.

Many on the checklist, together with the Achieved brothers, paid extra tax after modifications to company tax charges and different taxes by the federal government in a bid to assist greater welfare spending.

Robert Watts, who compiled the checklist, stated: “That is an more and more numerous checklist, with Premier League footballers and world well-known pop stars lining up alongside aristocrats and enterprise homeowners promoting pies, pillows and child milk.

“This 12 months there’s been an enormous leap within the quantity of tax we have recognized – largely due to greater company tax charges.”

Six taxpayers function on the checklist regardless of leaving the UK over the previous 12 months, amid experiences of rich people transferring to keep away from greater taxes beneath Labour, or attributable to non-dom standing being eliminated.

These included Wren Kitchens founder Malcolm Healey and sports activities promoter Eddie Hearn.