Tax adjustments introduced within the price range might have “devastating, unintended penalties” on reside music venues, together with widespread closures and job losses, commerce our bodies have warned.

The our bodies, representing practically 1,000 reside music venues, together with grassroots websites in addition to arenas such because the OVO Wembley Enviornment, The O2, and Co-op Reside, are calling for an pressing rethink on the chancellor’s adjustments to the enterprise charges system.

If not, they warn that a whole lot of venues might shut, ticket costs might improve, and hundreds might lose their jobs throughout the nation.

Politics newest: Ex-Olympic swimmer nominated for peerages

Enterprise charges, that are a tax on business properties in England and Wales, are calculated by way of a posh components of the worth of the property, assessed by a authorities company each three years. That’s then mixed with a nationwide “multiplier” set by the Treasury, giving a ultimate money quantity.

The chancellor declared in her price range speech that though she is eradicating the enterprise charges low cost for small hospitality companies, they’d profit from “completely decrease tax charges”. The burden, she mentioned, would as a substitute be shifted onto massive firms with huge areas, akin to Amazon.

However each small and huge firms have seen the assessed values of their properties shoot up, which greater than wipes out any low cost on the tax price for small companies, and can see the payments of enviornment areas improve dramatically.

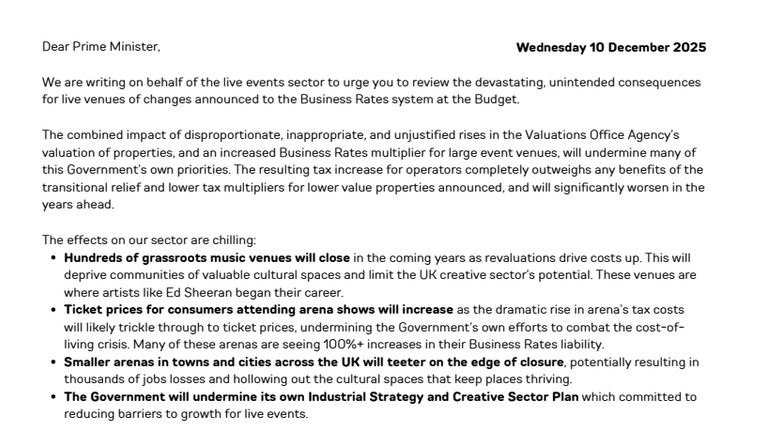

Within the letter, coordinated by Reside, the commerce our bodies write that the impact of Rachel Reeves’s adjustments are “chilling”, saying: “Lots of of grassroots music venues will shut within the coming years as revaluations drive prices up. This may deprive communities of useful cultural areas and restrict the UK artistic sector’s potential. These venues are the place artists like Ed Sheeran started their profession.

“Ticket costs for customers attending enviornment reveals will improve because the dramatic rise in enviornment’s tax prices will possible trickle by way of to ticket costs, undermining the federal government’s personal efforts to fight the price of dwelling disaster. Many of those arenas are seeing 100%+ will increase of their enterprise charges legal responsibility.

“Smaller arenas in cities and cities throughout the UK will teeter on the sting of closure, doubtlessly leading to hundreds of jobs losses and hollowing out the cultural areas that maintain locations thriving.”

They go on to warn that the federal government will “undermine its personal Industrial Technique and Inventive Sector Plan which dedicated to lowering obstacles to progress for reside occasions”, and also will cut back spending in lodges, bars, eating places and different excessive avenue companies throughout the nation.

To mitigate the impression of the tax adjustments, they’re calling for a right away 40% low cost on enterprise charges for reside venues, according to movie studios, in addition to “elementary reform” to the system used to worth business properties within the UK, and a “fast inquiry” into how occasions areas are valued.

In response, a Treasury spokesperson instructed Sky Information: “With Covid assist ending and valuations rising, some music venues could face increased prices – so we’ve stepped in to cap payments with a £4.3bn assist bundle and by protecting company tax at 25% – the bottom price within the G7.

“For the music sector, we’re additionally enjoyable short-term admission guidelines to chop the price of bringing in gear for gigs, offering 40% orchestra tax aid for reside concert events, and investing as much as £10m to assist venues and reside music.”

However Conservative shadow enterprise secretary Andrew Griffith instructed Sky Information: “The federal government has didn’t ship the reform to enterprise charges they promised, and wish to vary course earlier than extra jobs and venues are misplaced perpetually.”

The warning from the reside music business comes after small retail, hospitality and leisure companies warned of the potential for widespread closures because of the adjustments to the enterprise charges system.

Sky Information reported after the price range that the rise in enterprise charges over the subsequent three years following huge will increase within the assessed values of economic properties has left small retail, hospitality and leisure companies questioning whether their businesses will be viable past April subsequent 12 months.

Evaluation by UK Hospitality, the commerce physique that represents hospitality companies, has discovered that over the subsequent three years, the typical pub pays an additional £12,900 in enterprise charges, even with the transitional preparations, whereas a median resort will see its invoice soar by £205,200.

Learn extra: Hospitality pleads for ‘lifeline’

A Treasury spokesperson mentioned their cap for small companies will see “a typical unbiased pub pay round £4,800 much less subsequent 12 months than they in any other case would have”.

“This comes on prime of chopping licensing prices to assist extra venues supply pavement drinks and al fresco eating, sustaining our lower to alcohol responsibility on draught pints, and capping company tax,” they added.