What You Ought to Know:

– New evaluation of Texas hospital worth information reveals a transparency paradox: discounted money costs for widespread companies are sometimes considerably decrease than the charges hospitals negotiated with business insurers, in accordance with a brand new research study from Trilliant Health.

– For diagnostic colonoscopies, the median money worth was 32% beneath the median negotiated fee. This disconnect implies that workers on high-deductible well being plans (HDHPs) and the employers who sponsor them are doubtless subsidizing pointless healthcare prices.

The Market Paradox: When Being Insured Prices Extra

The federal Hospital Value Transparency rule, efficient since 2021, mandated that hospitals publish each their discounted money costs and the charges negotiated with insurance coverage firms. The intention was to extend worth consciousness and doubtlessly bend the rising healthcare price curve.

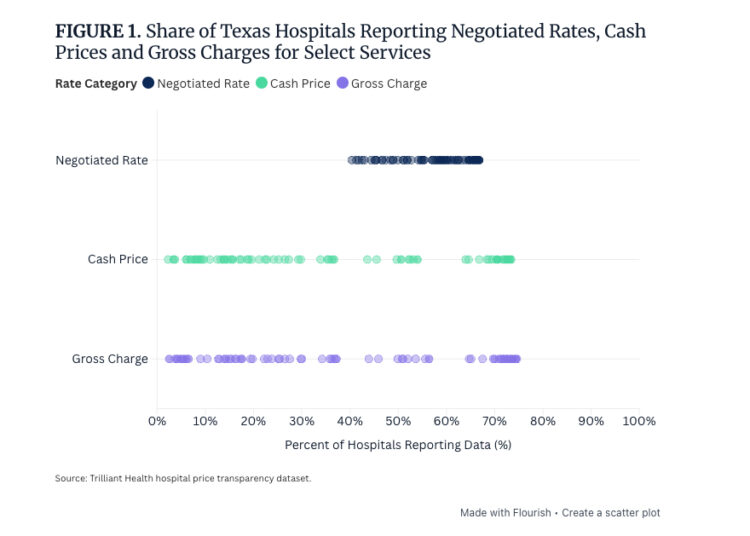

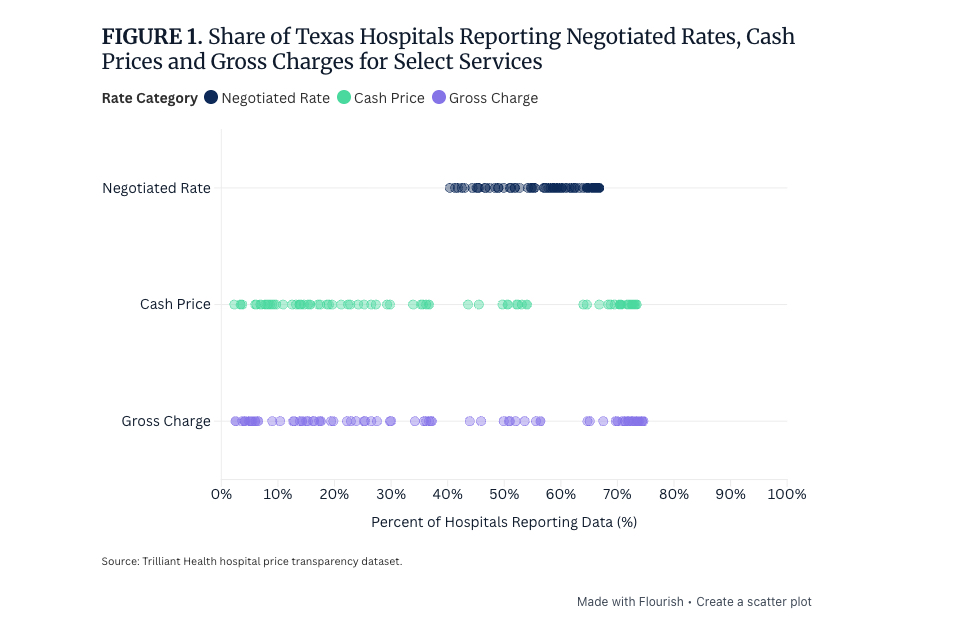

Nonetheless, the sensible actuality unearthed by analyzing this public information is placing: for 4 out of 5 widespread companies analyzed throughout 327 Texas hospitals, discounted money costs had been decrease than the negotiated charges secured by business insurers.

This discovering creates a elementary market paradox:

- For HDHP Members: Till a affected person meets their annual deductible, they’re accountable for the complete price of the service as much as that threshold. If the money worth is decrease than the negotiated fee, that insured affected person pays extra than an uninsured affected person would, regardless of paying insurance coverage premiums.

- The Diagnostic Colonoscopy Instance: For CPT 45378 (diagnostic colonoscopy), the median money worth was $1,554, which is 32% beneath the median negotiated fee of $2,275.

The one exception discovered among the many sampled companies was the sleep research (CPT 95810), the place the negotiated median fee ($1,473) was decrease than the money worth median ($4,644).

The Obstacles to Resolution Utility

Whereas the information is now theoretically obtainable, it’s functionally ineffective to the standard affected person or employer. This disconnect between information availability and resolution utility is rooted in a number of systemic points:

- Lack of Incentive: Commercially insured sufferers are nearly by no means accountable for the complete negotiated fee and have little incentive to give attention to the full price of companies.

- The Emergency Default: Roughly 50% of all hospital admissions originate within the emergency division (ED). Because of EMTALA, hospitals can’t inquire a couple of affected person’s means to pay, which means the default mindset for maximizing income for inpatient companies is to maximise billing to well being insurers.

- The Cognitive Burden: Even for actually “shoppable” companies, the complexity of understanding how deductibles, copays, coinsurance, and out-of-pocket maximums work together with each money and negotiated charges creates cognitive boundaries that stop knowledgeable decision-making.

In consequence, hospitals not often volunteer money alternate options, and few sufferers know or inquire about them.

Implications for Employers and the Well being Financial system

The results of this worth disconnect lengthen far past the person affected person with an HDHP.

- Employer Subsidies: Even after an insured affected person hits their deductible, the employer who sponsors the group well being plan continues bearing the monetary burden of inflated negotiated charges. When an employer’s supposed “group negotiating energy” yields charges increased than what an uninsured cash-paying affected person would pay, these employers are successfully subsidizing pointless healthcare prices.

- Worth Erosion: The research highlights the acute worth variation for the similar service on the similar hospital. Negotiated charges for a diagnostic colonoscopy different by 24x throughout well being plans. This implies the identical hospital can present excessive worth in a single community and low worth in one other, making the worth of a business insurance coverage profit extremely erratic.

- The Income Cycle Mindset: The default assumption for income cycle administration in hospitals is insurance coverage utilization, as uninsured sufferers symbolize solely a minor portion of hospital income. This ingrained mindset prevents the disclosure of helpful money alternate options on the level of care.

For worth transparency to maximise its worth, policymakers, hospitals, and employers should shut the hole between information existence and decision-making utility. Till comparative pricing data reaches sufferers and employers earlier than they want to decide on a supplier community—not after the very fact, like pricing in an airport retail store—transparency rules will stay a theoretical software quite than a sensible resolution for bending the healthcare price curve.