What You Ought to Know:

– The U.S. healthcare system is getting into 2026 with medical price tendencies harking back to 15 years in the past, going through persistent inflationary forces and vital federal coverage modifications, in keeping with a new report from PwC.

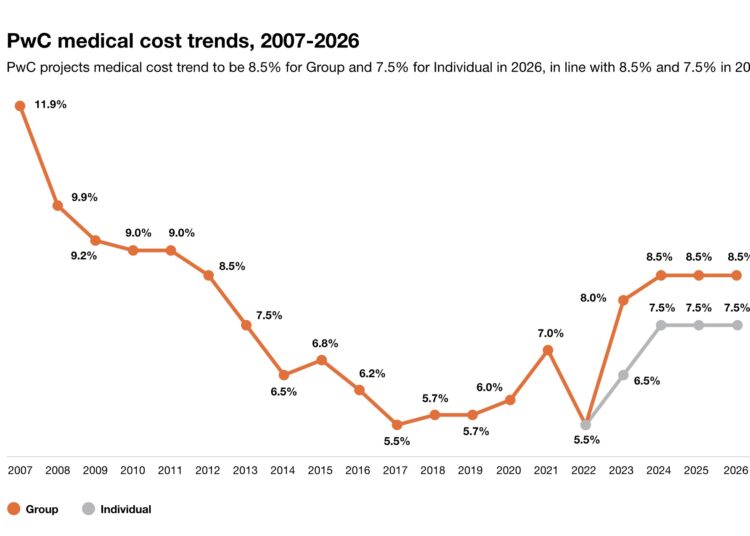

– The report, “Medical Cost Trend: Behind the Numbers 2026,” tasks the Group medical price development to stay at 8.5% in 2026 (the identical stage as 2025) and the Particular person market development at 7.5%. Pharmacy prices are a specific concern, projected 2.5 factors increased than the medical development.

PwC’s well being researchers surveyed and interviewed actuaries at 24 U.S. well being plans, overlaying over 125 million employer-sponsored members and 12 million Reasonably priced Care Act (ACA) market members, to generate these projections. All beforehand projected tendencies for 2024 and 2025 have been restated increased, signaling a sustained problem.

Key Inflators of Medical Prices

A number of components are driving the upward development in medical prices:

- Hospital Prices: Hospitals and well being programs proceed to face elevated costs for every little thing from wages to provides. Hospital year-end working margins averaged simply 2.1% in 2024, considerably under 2019 ranges (7.0%), and declined additional in Q1 2025. Many hospitals are coping by leveraging Income Cycle Administration (RCM) methods to maximise income seize, resulting in elevated inpatient admissions and better care severity that in the end shifts prices to business payers.

- Surges in Behavioral Well being Spending: Utilization of behavioral well being (BH) providers is hovering, with inpatient claims up practically 80% and outpatient claims up nearly 40% between January 2023 and December 2024. One in three well being plan actuaries surveyed named BH providers as a high three inflator, anticipating a ten% to twenty% development for behavioral well being subsequent yr.

- Drug Spending and New Therapeutics: U.S. drug spending grew by $50 billion (11.4%) to $487 billion in 2024. This development is pushed by oncology, immunology, cardiovascular, weight problems, and diabetes medication.

- GLP-1s: These weight-loss medication proceed to be a high price inflator for well being plans, projected to account for 0.5% to 1.0% of the estimated medical price development for 2026. Whereas they provide potential long-term well being advantages, challenges with adherence and sustained behavioral modification persist.

- Cell and Gene Therapies (CGTs): Whereas not but a significant price driver, there’s concern that these high-cost, breakthrough therapies (e.g., for sickle cell illness, hemophilia) will exert vital inflationary stress as extra enter the market and adoption will increase.

Federal Coverage Shifts Add to Value Pressures

Medical price development pressures are intensified by vital modifications in federal well being coverage and regulation, significantly the “One Large, Stunning Invoice” (OBBB/H.R. 1), signed into legislation in July 2025.

- Medicaid and ACA Subsidies: The OBBB is projected to cut back federal healthcare spending by $1 trillion over the subsequent 10 years by tightening Medicaid eligibility (probably resulting in hundreds of thousands extra uninsured by 2034) and permitting enhanced ACA subsidies to run out. This might immediate suppliers to hunt increased charges from business payers to compensate for diminished public funding.

- Tariffs: Proposed tariffs on pharmaceutical imports threaten to drive up drug costs and worsen shortages.

Deflators: Countering the Upward Development

Regardless of the inflationary forces, some components are working to mood price will increase:

- Biosimilars: Biosimilar adoption continues to be a key deflator. In 2024, private-label methods boosted Humira biosimilar uptake considerably. In 2025, an analogous development is rising with Stelara, as seven FDA-approved biosimilars (together with private-label variations) launch at over 80% lower than the reference product. Well being plans cite biosimilars because the main price deflator for the third consecutive yr.

- Strategic Value of Care Administration: Well being plans are seeing some success in managing the overall price of care by deploying utilization administration, claims integrity evaluations, pharmacy oversight, and prescription administration applications, typically weaving AI into their processes.

Act Now: Methods for Well being Plans and Employers

PwC emphasizes that price containment should turn out to be an working precept for well being plans:

- Strengthen Cost Integrity and UM: Well being plans want sturdy utilization administration (UM) and cost integrity applications, leveraging predictive analytics and pre-payment audits to forestall finances overruns and guarantee billing accuracy. Worth-based contracts will help shift prices again to suppliers.

- Rethink Pharmacy Profit Technique: This consists of auditing current pharmacy companions, exploring clear Pharmacy Profit Managers (PBMs) or Pharmacy Profit Directors (PBAs), and tightening oversight of GLP-1s via enhanced prior authorization and value-based contracts. Integrating GLP-1 protection with wraparound providers like vitamin counseling and digital teaching is essential for sustained well being advantages.

- Handle Excessive-Value Therapies: For CGTs, well being plans ought to discover progressive reimbursement fashions like outcomes-based rebates, milestone-based funds, and carve-out partnerships. They need to additionally streamline biosimilar approvals and push for clear rebate negotiations with PBMs.

- Embed AI and Digital-First Interventions: Well being plans ought to embed AI into care administration, pre-payment audits, and care coordination to spice up effectivity and affect. Prioritizing digital-first interventions that interact members with minimal overhead is crucial. Foundational investments in information infrastructure can sharpen analytics and improve fraud, waste, and abuse detection.

- Employer Engagement: Employers ought to set clear development targets and maintain well being plans and distributors accountable for efficiency metrics associated to GLP-1 oversight, behavioral well being integration, and pharmacy price drivers.

Name to Motion: Creating A Affected person-Centric Ecosystem

The 2026 medical price development alerts a necessity for daring reinvention in healthcare. Longer-term, this implies reallocating spending to create a patient-centric ecosystem centered on preventive, personalised, and predictive care, with versatile websites. Payers will turn out to be “well being architects,” steering care and managing prices, whereas suppliers leverage AI for effectivity and connectivity throughout the ecosystem.